Blended Finance for International Organizations: Diversify Funding, Scale Impact, and Access Private Sector Expertise

International Organizations (IOs) are on the front lines of the world's most pressing challenges, from climate change to poverty to conflict. But they're facing a continuous funding crisis. Blended finance models could be the key to unlocking the trillions of dollars needed to meet the Sustainable Development Goals (SDGs).

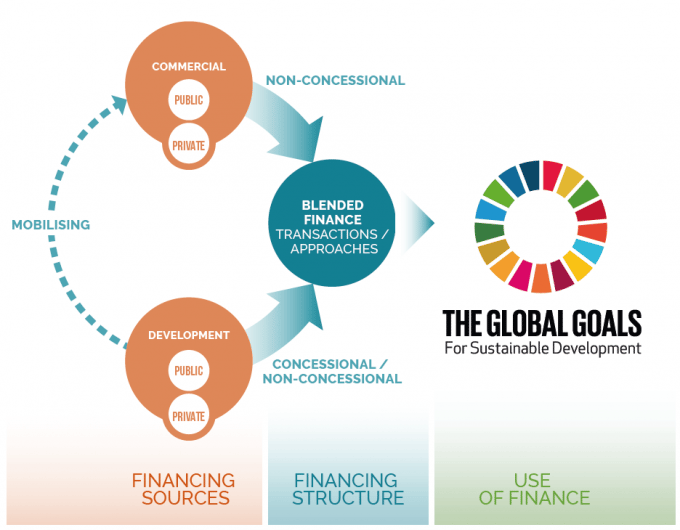

Blended finance models have become the new buzzword where the “blend” refers to the strategic use of various funding instruments to achieve social and environmental impact, which includes, for example public, private, and philanthropic capital.

By blending traditional donor finance sources with private capital, IOs can attract more investment to a wide range of activities, such as:

-

Scaling up existing programs and initiatives

-

Launching new and innovative projects

-

Investing in infrastructure and capital assets

-

Providing financial support to underserved communities

I am an impact entrepreneur, and I have been part of raising several financing rounds for Impactpool. I have noticed that Impact investors and organizations write most articles on the blended finance topic.

This text is written more from my perspective as an entrepreneur. I list some pros and cons and provide some ideas on how to start the "blending."

From a career transition perspective, if you are an expert in financing instruments and/or have hands-on experience in setting up complex financing models, your skills might never have been more needed for this sector.

How blended finance can help achieve the SDGs. Photo Credit: OECD